Asset management company VanEck has announced that Solana (SOL) has seen significant developments in Europe.

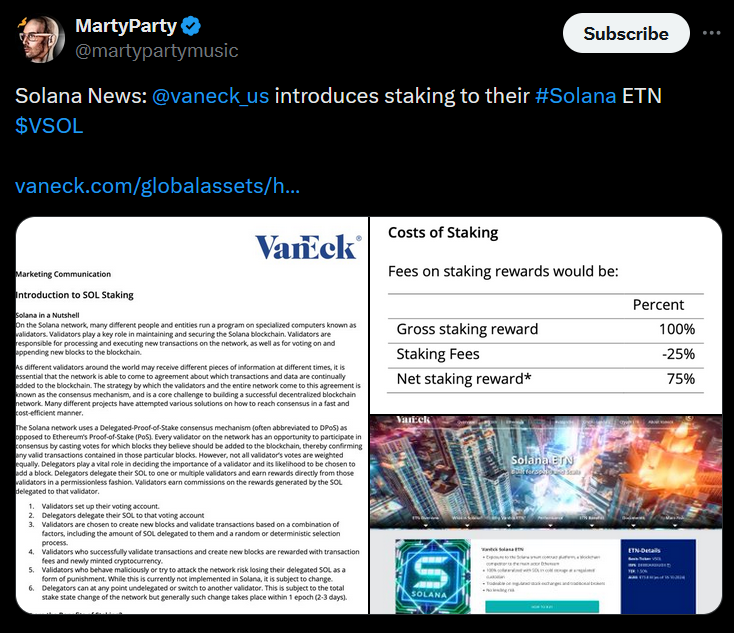

VanEck, one of the leading asset management firms, has just announced the successful implementation of staking features for the Solana exchange-traded note (ETN) in the European market.

The Solana ETN currently manages assets worth $73 million, and rewards from staking will be directly integrated into the token’s capital value, reflected in the net asset value (NAV) daily.

Founded in Liechtenstein, the Solana ETN is a digital trading product that tracks the price of Solana (SOL).

Staking rewards will be accumulated and reinvested daily, increasing the end-of-day value, according to Mathew Sigel, Head of Digital Asset Research at VanEck.

He also mentioned that Solana has a shorter and easier staking cycle compared to Ethereum, which had already offered staking earlier.

Sigel emphasized that European regulations regarding staking features in trading products are more flexible compared to the United States, enabling VanEck to implement this feature more efficiently.

On the issue of security, Sigel explained that VanEck does not directly hold customers’ funds due to traditional financial regulations.

Instead, the physical SOL is held by a custodian and staking rights are delegated to a validator.

Even though the validator node is operated by a staking provider, the assets remain under the control of the custodian and are securely stored in cold storage.