ENA has seen a breakout price surge, reaching nearly $1.20, driven by a 63.42% increase in trading volume to $538.61 million and a 22.15% rise in open interest to $189.05 million.

The $42,000 incentives from Euler Labs have boosted this growth as traders actively capitalize on ENA’s price potential.

Descending Triangle Breakout Signals a Price Rise to $1.20

Ethena’s ENA token broke out from a descending wedge pattern, signaling a bullish reversal. According to analyst ZAYK Charts, ENA could increase by 100%-120%, targeting a price range of $0.85 to $1.00.

The breakout from this pattern is a sign that buyers are regaining momentum, with higher trading volumes supporting the bullish outlook.

If ENA holds above the previous resistance level, the price could continue to rise toward the expected target.

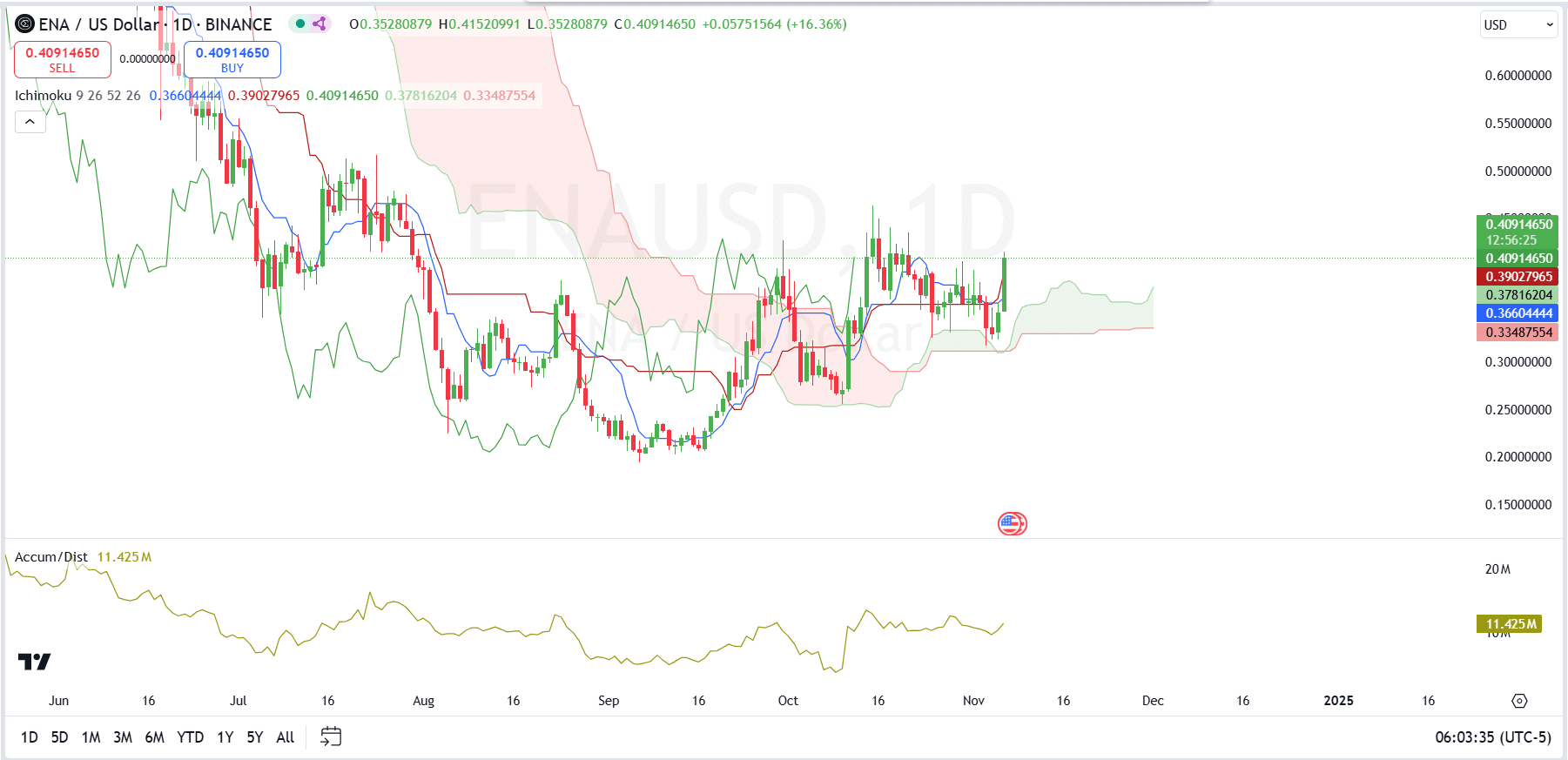

ENA Climbs Above Ichimoku Cloud

Technical indicators align with a bullish sentiment surrounding Ethena, as the Ichimoku Cloud shows an uptrend when ENA is above the cloud.

The Tenkan-sen line crossing above the Kijun-sen line supports short-term buying momentum, reinforcing ENA’s potential for price growth.

Additionally, the Accumulation/Distribution line highlights steady growth – a sign of ongoing buying interest from traders.

Euler Labs Enhances ENA’s Utility with New Collateral Options

Euler Labs has introduced PT-sUSDE as a new collateral option on the Stablecoin Maxi platform, with a total incentive of about $42,000, including $25,000 in $PYTH rewards and $17,000 in Euler-matching rewards.

Users can borrow sUSDE from Ethena Labs and use PT-sUSDE as collateral. ENA is currently trading at $0.41, up 21% in the last 24 hours, with a market cap of $1 billion and a trading volume of $301 million. The addition of PT-sUSDE could drive demand and increase ENA’s value.

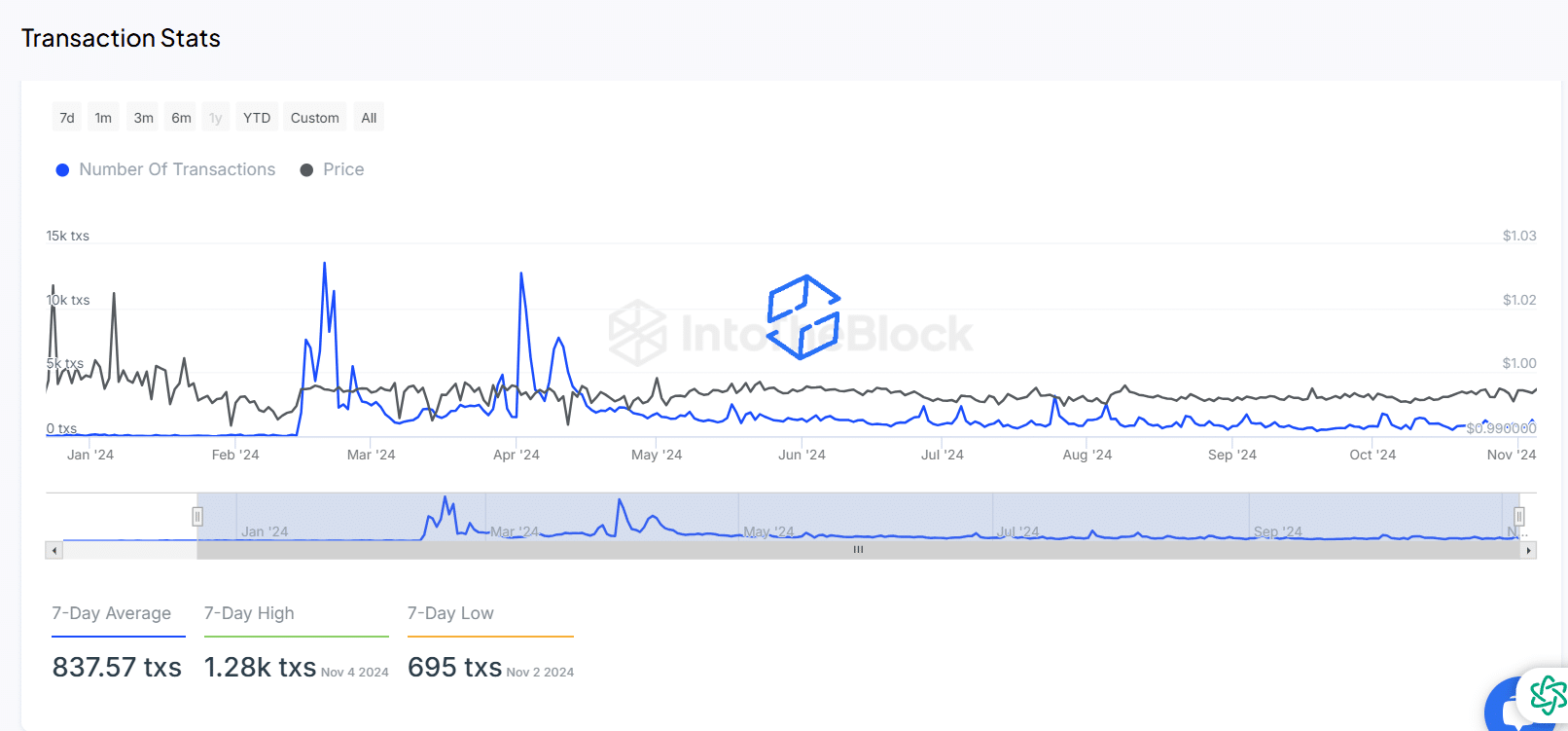

Steady Trading Volume Shows Stable Demand

Ethena’s trading data further supports its stable presence in the market, with a 7-day average of 837.57 trades and a recent high of 1.28K trades on November 4, 2024.

Stable trading volume and price stability around the $1 mark suggest consistent demand and minimal volatility in recent months. The price stability, despite fluctuating trading volumes, also highlights a balanced market environment for ENA.